In 2025, the Rolex Daytona remains one of the hardest watches in the world to buy at retail — and that’s entirely by design. The stainless steel reference 126500LN might be the most recognizable modern chronograph in the world, yet it’s still nearly impossible to acquire at retail. Even with Rolex’s global reach and massive production output, buying a Daytona from an authorized dealer today isn’t about being a loyal fan of the brand or even about having the money ready — it’s about how much you’ve already spent, and where you stand in the increasingly competitive ecosystem of Rolex’s distribution model.

If you’re new to the game or still holding onto the belief that politeness and persistence at the boutique might someday land you a call, it’s time to recalibrate. The system has evolved. The Daytona is no longer a watch you “get lucky” to receive. It’s a watch you buy only after having already bought a lot of other things first.

A Shifting Dealer Landscape

One of the biggest changes in recent years has been Rolex’s acquisition of Bucherer in 2023. That move wasn’t just symbolic — it was a signal that Rolex intends to exert more direct control over its retail presence. While most of the market’s attention focused on the implications for Bucherer’s massive multi-brand footprint, the message to smaller ADs was loud and clear: performance matters, and distribution isn’t forever.

In the past, there was a sense that if you were friendly with your local AD, you might eventually be offered something special. Today, most ADs are under such tight scrutiny that they can’t afford to make emotional decisions. Allocation is data-driven. Every Daytona they receive must go to a client whose spending history justifies the privilege. And more importantly, they need to be confident that the piece won’t end up flipped on the secondary market days later — a mistake that could cost them their entire Rolex relationship.

What Counts Toward Purchase History

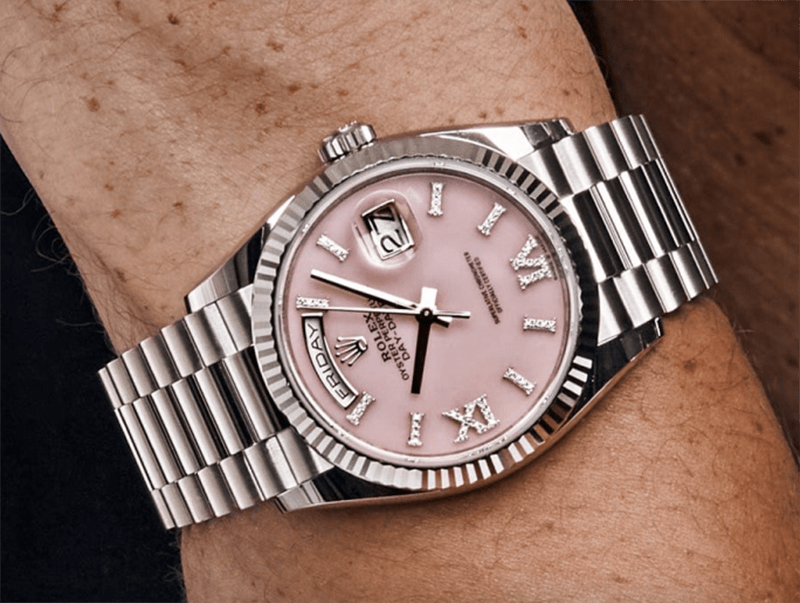

When people talk about “building a profile” with an AD, what they’re referring to is cumulative, trackable spend across the dealer’s full range of inventory. That includes Rolex models that aren’t in demand — think Datejust 31s, two-tone Sky-Dwellers, or gold Day-Dates — as well as jewelry, watches from other brands, and accessories.

Some Rolex ADs also carry lines like Tudor, Grand Seiko, Cartier, or Omega. These watches may not be as exciting, but they contribute to your profile. In some boutiques, a bridal jewelry purchase carries just as much weight as a Submariner. This is especially true in high-volume urban locations where ADs operate with quotas across multiple categories. The sales associate might smile and tell you they’ll “see what they can do,” but behind the scenes, your name is being ranked in an internal CRM against hundreds of others who’ve spent more.

It’s not personal. It’s math.

The Role of the Daytona in Rolex’s Brand Strategy

To understand why Rolex makes it this hard to buy a Daytona, it’s important to remember that scarcity is part of the plan. The Daytona isn’t just a watch — it’s a brand accelerant. It drives traffic, headlines, resale premiums, and cultural capital. From Paul Newman to John Mayer to Le Mans drivers, the Daytona has been the halo piece of the Rolex catalog for decades.

Limiting access to the Daytona allows Rolex to reinforce the prestige of the brand while subtly nudging clients toward models with higher margins or slower sell-through. Want a Daytona? First, prove you’re committed to the brand. That’s how the game is played — and ADs are incentivized to stick to the rules.

Why the Waitlist Isn’t a List

The term “waitlist” has been misleading for years. Most ADs don’t operate on a first-come, first-served basis. Instead, they maintain a soft hierarchy of preferred clients based on spend history, longevity, and perceived loyalty. Some clients wait five years and never get the call. Others are offered a Daytona within six months — not because they’re lucky, but because they’ve already spent $100,000 or more with that dealer.

It’s also worth noting that ADs don’t always control when they receive Daytonas or which configurations they get. Allocations are unpredictable. When a piece does arrive, they’ll typically offer it to a client who has proven to be low risk and high value. In this environment, simply being “on the list” doesn’t mean much unless your name sits near the top.

A Note on Off-Catalog Daytonas

In addition to the core steel models, Rolex produces several off-catalog Daytona variants — typically crafted in precious metals with unique dials, exotic materials, or unusual configurations. These watches aren’t listed on Rolex’s public website, and while they’re not officially secret, they’re treated as such by design. These include models like full gold Daytonas with meteorite dials, baguette-set hour markers, or platinum pieces with unique bezel configurations.

Access is even more limited than with standard production Daytonas. Off-catalog pieces tend to go to Rolex’s most established clients — collectors who have demonstrated long-term loyalty, high dollar spend across multiple categories, and a history of not flipping watches. If you’re starting from zero, these models are effectively out of reach at retail. Even if you’re well into the Rolex ecosystem, you’ll likely only be offered one after years of consistent, top-tier spending.

Why the Secondary Market Is the Practical Route

Given the reality of the AD system, many buyers are choosing to skip the wait and go straight to the secondary market. And while paying over retail might seem like a compromise, the logic often checks out:

-

You get the exact model and dial you want without delay

-

You avoid buying inventory you don’t actually want

-

You skip the multi-year waitlist dance and relationship management

-

You retain control over what you buy, when you buy, and how much you spend

Let’s do the math. If it takes $100,000 in purchases to earn a Daytona allocation, and $50,000 of that is tied up in watches or jewelry you wouldn’t have otherwise bought, your effective cost of acquisition is much higher than just paying a secondary premium. In contrast, you might be able to buy that same Daytona from a reputable dealer today for $35,000 to $40,000. In that context, the premium isn’t a markup — it’s a shortcut.

When Buying at Retail Makes Sense

There are situations where pursuing a Daytona at retail still makes sense. If you’re already a longstanding client, actively collect across Rolex or other brands in your dealer’s assortment, and enjoy the experience of building with your AD, then continuing down that path is logical. But if the Daytona is your sole target, and you’re just getting started, retail is more likely to be a long, uncertain, and expensive route.

Final Thoughts

The Rolex Daytona in 2025 is no easier to get than it was five years ago. In many ways, it’s harder. The game has matured, the margins have tightened, and the rules are more rigid. Being polite, persistent, or passionate isn’t enough anymore. What matters is spend — and lots of it.

The good news is that the secondary market gives buyers an alternative. Not a compromise. Not a plan B. But a strategy based on control, immediacy, and clarity.

No waitlists. No games. Just 100% authentic watches you can own today.